Viscose extends the downtrend, prices yet to bottom out

YarnsandFibers News Bureau 2014-03-26 18:11:00 – MumbaiBearish end-use sentiment has been casting dark clouds over the entire chemical fiber industry in recent times and prices of most textile inputs have hit an 11-year low. Viscose industry is no different. Viscose producers have been snagged with great losses and the downtrend is predicted to continue. Manufacturers may successively cut production or undertake plant turnarounds to support prices.

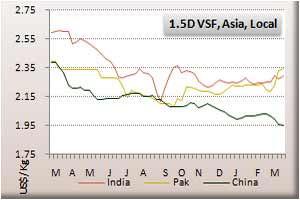

In the week of 21 March, viscose staple markets extended the downtrend and downstream buyers continued buying on a need-to basis, with large volumes deal scarcely seen in the market. At the beginning of this week, most medium-end VSF producers in China announced new pricing policies. The second half of the week saw price fall slowly and enquiries improved. But trading volumes still lacked significant increase. In China, talks for high-end VSF stood at US$1.95 a kg, down US cents 4 from last week. In Pakistan, 1.5D VSF prices were at US$2.34 a kg while Indian VSF were steady at US$2.23-2.34 a kg. VSF prices are expected to fluctuate in weakness in coming week.

In viscose filament, the markets were steady to slightly firmer in the week as producers in China were keen to push up offers in order to recoup losses. However, actual buying from downstream was moderate and producers met with resistances from downstream players. In China, offers remained unchanged from last week for the first-class VFY 120D at US$5.86-6.26 a kg. In India, stronger INR pushed price in US$ term up US cents 3-5 a kg with 100D bright VFY pegged at US$6.65-6.68 a kg.

Viscose raw material saw offers for softwood pulp were sustained at above US$900 a ton, while those for hardwood pulp were not lower than US$870 a ton. In China, discussion for dissolving pulp was at an impasse and some makers held offers firm at US$1,075 a ton. There were few fresh offers and trades heard in the imported dissolving pulp market.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide