Sun Capital sells its investment in Frontier Spinning Mills

YarnsandFibers News Bureau 2014-01-06 14:40:00 – Boca RatonSun Capital Partners, a leading private investment firm has announced the sale by an affiliate of its investment in Frontier Spinning Mills to American Securities LLC. Frontier, headquartered in Sanford, North Carolina, is one of the largest producers of spun yarns for the knitting and weaving industries.

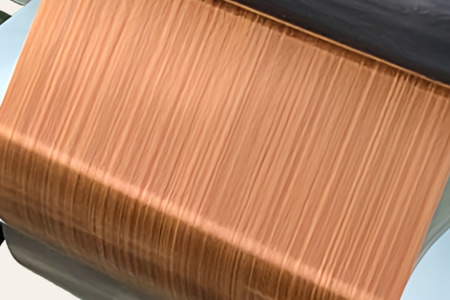

Frontier offers a diverse product line, with market-leading positions in open-end and air jet spinning technologies.

Yarn produced by Frontier is used in the production of sportswear, undergarments, socks, sweaters, fleece, denim, and home furnishings. The company operates state-of-the-art manufacturing facilities in multiple states and employs 1,076 people.

Following the acquisition of Frontier by an affiliate of Sun Capital, the management team was strengthened, the company reports, and its operations were optimised.

Frontier made substantial investments in capital equipment and training to further modernise and broaden its operations and product set through the implementation of leading-edge technologies.

Sun Capital Partners is a pioneer in private equity investing. It has experience in the textiles and industrial fabrics sector through current affiliated portfolio companies, including Performance Fibres, a leading supplier of high-tenacity polyester fibres and fabrics, Nylon-6, engineered fabrics, sewing thread fibres and advanced materials.

According to Marc Leder, Co-CEO at Sun Capital, Frontier’s emergence as the second-largest cotton spinner in the US validates the success and progress the company has achieved under their ownership. They are confident the company is well-positioned for continued growth as a result of its increased plant capacity, streamlined manufacturing footprint, optimised productivity, and expanded product line.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide