Polyester pricing may see hikes in April and May, but fall later

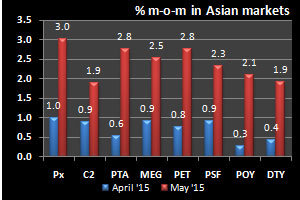

YarnsandFibers News Bureau 2015-04-10 11:30:00 – MumbaiEverything in synthetic fibre markets, especially polyester, has been revolving around crude oil price, and hence the US$. The first signs of policy change in US, expectation of a hike in interest rates, have led to a flight to the US$, supported by other currencies being devalued. And with world powers reaching a framework agreement with Iran to curtail its nuclear program, the stage has been set to end the sanctions that have restrained Iran’s exports. The tentative agreement clears the way for discussing detailed settlement that should ease Western fears that Iran is seeking to build an atomic bomb, in exchange for lifting the economic sanctions. Easing sanctions would allow Iran to sharply increase its oil exports, further straining a market that is already grappling with oversupply and hence exert pressure on oil prices. YnFx believes that crude oil prices with rise, both in April and more pronounced in May, but move south later until September 2015. Thus, the polyester chain pricing, beginning from ethylene to filament and spun yarn will follow up.

In March, Asian ethylene (one of the primary feedstock to produce polyester) was dearer on tight supplies and prices hit a 5-month high on unplanned outage in the last week. Prices were up 28% on the month averaging US$1,209-1,211 a ton CFR SE Asia. For April, ethylene spot is likely to remain flat to up as supply tightness will ease with crackers returning from turnarounds. The expected rise in oil price in May will support ethylene pricing move up atleast by US$20 during the month. Paraxylene (another feedstock for polyesters) spot prices declined in March on weak demand and uncertain outlook. Asian marker, the CFR China averaged US$847-848 a ton, down 2% on the month. Prices in April may see partial recovery as the markets will be weak but run in line with upstream and jump in May on oil support.

MEG and PTA, the two polyester intermediates have been following their respective feedstock ethylene and paraxylene markets. MEG prices see-sawed throughout March in Asia but inched up on the month. Bearish sentiment held high opening the month, after retreating from rushing high post Spring Festival holidays. The Asian marker was up 0.4% in March averaging US$825-828 a ton FOB SE Asia. Spot is likely to increase atleast 1% in April, given the surge in ethylene price in March and further by US$25 in May. PTA prices soared opening March but as supply dried and prices kept falling later. However, it ended the month up 4.6%, averaging US$623-625 a ton CFR China. A better performance in polyester sector is likely to support PTA markets in April, which may probably see the first round of bottoming-out and rising in May.

Polyester chip prices edged down in Asia with offers for semi dull chips at US$1,032-1,050 a ton a ton while super bright chip were also at US$1,030-1,060 a ton. April may not be able to recoup this fall but demand emerging from end April will help chip markets to recover most of the losses and move up further in May. Polyester filament prices were mostly stable in March while a few producers raised offers. In China, POY 75/72 were almost flat at US$1.30-1.32 a kg in Shengze market while Indian POY 130/34 prices were steady at US$1.47-1.49 a kg, unchanged from last month. PSF markets saw prices firming and increase in trade volume in end March. In China, 1.4D PSF was pegged at US$1.14-1.19 a kg, down US cents 3-4 from last month. Indian PSF prices were at US$1.26 per kg, up 2.6% from February. April will not see any major change filament and fibre prices, but cost support may help markets stabilize and price rising marginally by US cents 1-2 during May.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide