Paraxylene tanks no major shakeup yet in downstream

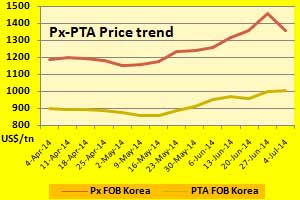

YarnsandFibers News Bureau 2014-07-08 17:51:00 – MumbaiAsian ethylene prices were up, although in varying degree on persistent tight supply amid several turnarounds. European ethylene spot prices gave back recent gains following a slump in naphtha prices. In US, spot ethylene prices slipped in an abbreviated week despite an increase in contract prices. Asian paraxylene markers was down US$99.50 a ton on the week to be assessed at US$1,359-1,360 a ton FOB Korea and US$1,381-1,382 a ton CFR Taiwan/China. A week ago, they had surged more than US$100 a ton.

European spot paraxylene price was assessed at US$1,285 a ton FOB ARA, down US$65 on the week after surging US$70 last week. US spot paraxylene prices declined US$80 in the week, assessed US$1,280 a ton FOB USG. With paraxylene falling and naphtha inching up the spread between the two narrowed down to US$375 a ton from US$477 a ton in the previous week, a clear fall of US$102 in a week. In similar comparison, European spread came down to US$511 a ton in the form US$US$562 a ton in the previous week.

Downstream implication was not yet seen since Asian purified terephthalic acid prices rose, although not sharply, despite the collapse in paraxylene markets. In China, the Zhengzhou futures rebounded on domestic supply tightness while activity in European spot PTA market was thin, with no major indications emerging. Asian PTA marker rose US$5 week on week to be assessed at US$1,000 a ton CFR China and US$1,006 a ton South East Asia. However, the MEG markets in Asia felt some tremor as prices declined. Asian MEG prices fell US$20 week on week to be assessed at US$1,001-1,006 a ton CFR China and US$1,003-1,005 a ton CFR Southeast Asia.

Polyester chip markets were stable to strong on the recent ascend in raw material costs and moderate demand. Polyester filament yarn trading was still weak in Asian markets and firm deals were limited. In China, the Fujian PFY market was stable amid falling trading and weak buying interest. In India, POY prices inched up on cost support and amid good trading. In Pakistan, DTY market was broadly stable as PTA remained strong recently. Polyester staple fibre markets stabilized, but trading remained generally weak.

Entering July, although PTA and MEG prices remained firm, paraxylene prices continued to collapse resulting in mixed sentiment in polyester markets. PSF prices were mostly stable in China, with previously offers coming slightly off and sellers more keen to offload. In India, PSF prices were hiked to cover cost, while they were stable in Pakistan.

Courtesy – YnFx Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide