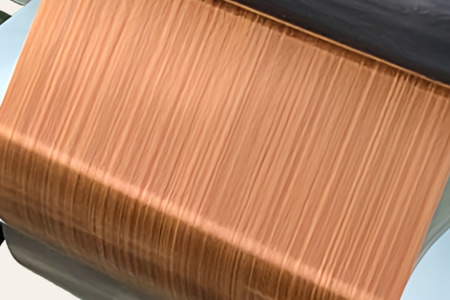

Pakistan govt policies fail to encourage textile sector in last five years

YarnsandFibers News Bureau 2014-07-20 12:00:00 – KarachiThe All Pakistan Textile Mills Association (Aptma) on Friday appreciated the overall increase in textile exports, which went up by 3.9 percent, but expressed trepidation over decline in exports to the rest of the world other than the European Union. This decline could have been avoided if the government addressed the issues, which resulted in the decline.

The Aptma has expressed disapproval of the government policies, which have failed to encourage investment in the textile sector during the last five years, as their competitor, India has made huge investments due to the positive and business-friendly environment provided by their governments.

According to Yasin Siddik, chairman of Aptma, to facilitate the industry and to stand up fight energy shortages, the new Indian government has provided 10-year tax holiday to new investors who begin generation, distribution and transmission of power by March 31, 2017. A high-level committee has also been setup in India to interact with the trade and industry on a regular basis to determine areas where clarity in tax laws is required.

The increase in Pakistani export could have been higher by at least 10 percent if the effect of massive revaluation of the rupee against the dollar and other foreign currencies was translated into a decrease in the cost of production, especially electricity and gas tariff and the discount rate, which was the highest in the region and decrease in the prices of petroleum products.

Unavailability of energy, high interest rates and stuck up liquidity on drawbacks and refunds have played a vital role in the lower growth and exports of the textile industry.

Aptma wants the law and order situation need to be put in place for making Pakistan a reliable and dependable sourcing destination for textile and clothing importers globally.

Apart from that they have also urged the government to take stock of the situation and save the largest export earning industry of the country by reinstating feasibility of textile industry through provision of uninterrupted energy supply at competitive rates, immediate release of unsettled sales tax refunds, withdrawal of Gas Infrastructure Development Cess, withdrawal of increase in the import duty on spares and accessories of plants and machineries, and withdrawal of increase in the import duty on raw materials.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide