Pakistan Customs proposes imposing regulatory duty on importable goods

YarnsandFibers News Bureau 2016-04-16 14:00:00 – KarachiThe Pakistan Customs Appraisement South, in its budget proposals for 2016/17 proposed that regulatory duty be enhanced on a number of importable goods as various statutory rates of import duty, under the FTA (free trade agreement) regime provide opportunity to the importers to get items cleared under the minimum duty slab.

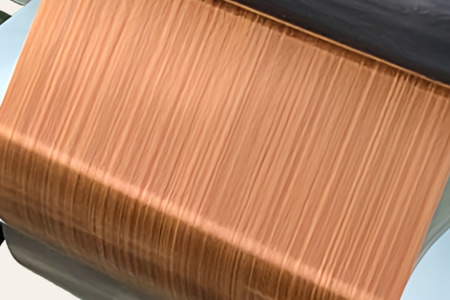

Customs proposed the Federal Board of Revenue (FBR) to impose five to 20 percent on importable goods to avert the incidences of mis-declaration, which cause revenue losses to national exchequer. It is, therefore, proposed that regulatory duty be enhanced to 15 percent from existing 10 percent on import of woven cotton fabric.

There are various rates of import duty on similar goods with only structural formation difference. Generally, the importers declare goods with vague and fake descriptions to claim the minimum duty slab.

The Customs Appraisement South said that it is proposed that regulatory duty be imposed on goods importable under lower duty slabs to rationalize the duty structure.

The department advised the FBR to specify same concessionary rate of sales tax on raw materials and goods imported by manufacturers/industrial consumers as well as commercial importers.

Commercial importers as well as industrial consumers should be given same rates of sales tax as it is difficult to check genuine manufacturers at import stage.

According to a statutory regulatory order (1125(I)/2011), sales tax is charged at three percent on industrial inputs imported by manufacturers of the five export-oriented sectors. In case of commercial importers, value addition tax of three percent is also charged in addition to one percent sales tax at the import stage.

According to the budget proposals document a majority of the commercial importers have managed to got themselves registered as ‘manufacturer’ with a view to misuse the SRO, resulting in revenue loss. For example, it added that the balance of imports of textile yarn has abnormally shifted in favour of manufacturers from commercial importers.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide