New customs value fixed on import of textile lining material

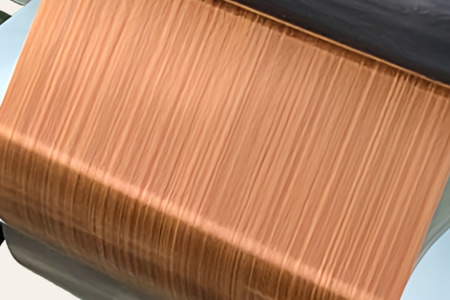

YarnsandFibers News Bureau 2014-01-14 15:10:00 – KarachiPakistan has imposed new customs value on import of textile lining material from China It is learnt here on Monday that the Directorate General of Customs Valuation Karachi has issued a new valuation, which has superseded Valuation Ruling No 483/2012. According to the ruling, the customs value of textile lining material was earlier determined vide Valuation Ruling No 483/2012, dated 25-10-2012. The Directorate has fixed $3 per kg as new customs value on import of textile lining material from China.

The valuation methods given in Section 25 of the Customs Act, 1969 were followed. Transaction value method provided in Sub-Section (1) of Section 25 was found inapplicable because requisite information as per law was not available. Identical / similar goods value methods provided in Sub-Sections (5) & (6) of Section 25 of the Act ibid were examined for applicability to the valuation issue in the instant case. These methods furnished unreliable values and were not found applicable. Deductive Value Method under Sub-Section (7) of Section 25 was, therefore, adopted to determine customs values for Textile Lining Material in this case read with Sub-Section (9) ibid. Meetings were held with the stakeholders and attended by representatives of FPCC&I and KCC&I who provided feedback regarding the valuation of subject goods.

In cases where declared/transaction values are higher than the Customs value determined in the Ruling, the assessing officers shall apply those values in terms of Sub-Section (1) of Section 25 of the Customs Act, 1969. In case of consignments imported by air, the assessing officer shall take into account the differential between air freight and sea freight while applying the Customs value determined in the ruling.

The value determined vide this Ruling shall be the applicable Customs value for assessment of subject imported goods until and unless it is rescinded or revised by the competent authority in terms of Sub-Section (1) or (3) of Section 25-A of the Customs Act, 1969. The Collectors of Customs may kindly ensure that the value given in the Ruling be applied by the concerned staff without fail, it added.

Various representations were received, including representations made by KCC&I regarding revision of Customs value of the said goods to reflect the current price trend of these goods in the international market. This prompted an exercise to re-determine Customs value of Textile Lining Material under Section 25A of the Customs Act, 1969.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide