Implications of TTP provision yarn forward on China and Vietnam

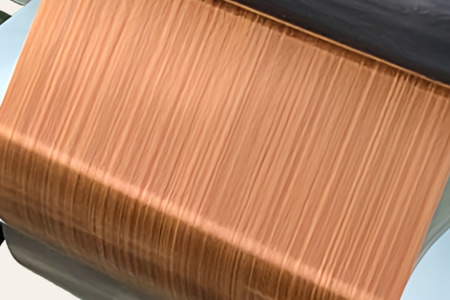

YarnsandFibers News Bureau 2015-11-05 12:00:00 – ChinaAn important element of the Trans-Pacific Partnership (TPP) trade bloc, the 'Yarn Forward' agreement - a component part of the Textiles and Apparel section has very specific implications for China, Vietnam and Malaysia. Under this provision, only yarn made by TPP members may be sold onto the TPP markets, which includes producers and consumers such as the United States and Japan.

The textiles manufacturing businesses across the TPP are something of a mixed bunch. Countries such as the U.S. and Japan are capable of producing very fine luxurious products; others such as Vietnam have largely been dependent on sourcing lower quality products from China and integrating them into finished items.

The Yarn Forward scheme therefore has very specific implications for both countries. As the U.S. Association of Importers of Textiles & Apparel (ITA) put its view of the TPP. This provision has numerous implications on:

Vietnam can provide low cost manufacturing at an equivalent current productivity ratio of about 70 percent of that achievable in China. However, its textiles industry relies heavily on cheap Chinese imports of yarn. In order to take advantage of the TPP agreement and sell onto the lucrative markets of Japan and the United States, it will need to change its sourcing habits across the entire textiles industry. Suppliers could include the

United States and Japan for high quality items, and Malaysia, Mexico and Peru for lower quality production. Obvious and significant trade routes have opened up in this area assuming Vietnamese manufacturing can be upgraded to ensure quality sustainability. This alone may drive U.S. investors to Vietnam to assist with machinery upgrades via joint ventures and U.S. owned factories.

Malaysia, Mexico & Peru : Each of these countries may gain spin off benefits by seeing investment in their textiles industries to support trade with the U.S. and to upgrade existing facilities.

United States : The TPP agreement also contains significant aspects concerning the upgrading of IP protection and the enforcement of this – good news for the American fashion industry, long frustrated with copycats in China.

By bypassing Chinese production, the U.S. has opened a window for trade in the form of raw yarn to be exported, finished elsewhere under more secure conditions available in China, then re-exported back to the U.S. consumer. Accessing cheap yet well organized labor is part of this opportunity; Vietnam and Mexico both offer solutions.

China : The TPP Yarn Forward provision is obviously bad news for China’s textiles and apparel manufacturers. Unfortunately they may now be paying the price for decades of combining official production capabilities with pirating goods as well. The Chinese yarn manufacturing industry is now effectively limited to China’s domestic market and those of the ASEAN agreement. China is also about to lose the entire Vietnamese market in addition to being effectively cut off from U.S. trade. While this sounds draconian, in actual fact the Chinese industry has been in decline for a number of years, losing much of its base to Bangladesh and, to some extent, India. However, the message for foreign investors in China’s textiles and apparel markets is clear – it is now time to seriously look at investing in Vietnam as an alternative.

For Washington, it is tempting to think of the fashion industry having finally put one over the pirates. For China, it is the legacy of not cracking down on counterfeit products sufficiently.

The TPP agreement contains multiple provisions that will redirect global supply chains for certain products, as well as upgrade and enhance IP protection. This has very specific implications for American and other foreign investors throughout the region.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide