Have Indian spun yarns become competitive?

YarnsandFibers News Bureau 2015-04-30 11:03:00 – MumbaiExport volume of spun yarns from India continue to grow in March 2015, while prices retreated compared to their year ago levels. At this price level, it appears that spun yarns made in India have become globally competitive, particularly of cotton. The fall in prices reflect the decline in raw fibre cost in India.

In March 2015, Cotlook ‘A’ index fell 29 per cent YoY, while global benchmark the US Cotton futures declined 33 per cent. Cotton was 24% cheaper in Pakistan and 30 per cent down in China. Indian cotton too was cheaper in similar comparison. Shankar-6 prices were down 25 per cent in March while the coarser variety, Bengal Deshi was cheaper by 20 per cent. However, this kind of fall is not seen in prices of cotton or cotton blended yarn which leaves room for further fall, thus making Indian yarn more competitive.

Even manmade fibre prices mirrored similar trend. Polyester fibre was 19 per cent cheaper in March 2015 at INR79.60 per kg compared to a year ago, while acrylic staple fibre prices at INR149 a kg were down 17 per cent. However, viscose fibre prices were stubbornly pegged at INR141.50 a kg. Thus, raw material cost for making blended yarns declined sharply.

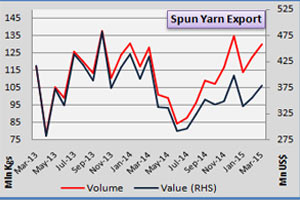

All kinds of spun yarn exported were up in March with volumes at over 130 million kg worth US$380 million or Rs 2,340 crore, implying per unit value realisation of US$2.91 per kg. This was US cent 1 up from previous month but down US cents 48 from March 2014. Compared to last year, volumes were up 1.5 per cent while earnings in US$ term fell 13 per cent implying a 14 per cent fall in unit price realization. Meanwhile, the Rupee appreciated 0.4 per cent against the US$ in the comparable months.

Eighty eight countries imported spun yarn from India with China on the top accounting for 37 per cent of India’s total spun yarn exported in March. This was 11 per cent higher than the value of export last year while shipment volume increased 29 per cent YoY.

Bangladesh was the second largest importer of Indian spun yarns, accounting for 13 per cent of all spun yarn exported from India. It reduced its imports from India by 6 per cent in value and 8 per cent in terms of volumes. Egypt continued to remain the third largest importer of spun yarns, ahead of Turkey and South Korea which have also reduced imports from India.

Taiwan, Dominican Republic, Chile, Ecuador and Mexico were the fastest growing markets in March for Indian spun yarn exports. However, they together accounted for only 2.3 per cent of total exports.

Countries which did not import any yarn from India in March were Honduras, Estonia, Malawi, Zambia and Iraq while Djibouti, Israel, Croatia, Bulgaria and Bahrain significantly reduced their imports from India this March compared to their levels a year ago. Panama, Botswana, Paraguay, Cuba and Slovakia were the major new destinations for Indian spun yarns in March, which together imported US$0.50 million worth of spun yarns.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide