Decline in crude prices in November escalates into polyester chain

YarnsandFibers News Bureau 2015-12-18 15:55:00 – MumbaiCrude oil prices in November declined on pressure from a rallying US$ and expectations of higher interest rate. The US$ hit 6-1/2-month high against a basket of currencies. Data also showed eight straight weeks of inventories builds in US. Brent, the global benchmark for oil, was less than $2 from setting new 6-1/2-year lows in the mid of November. US crude and Brent price fell 6.8% and 7.4% respectively as compared to previous month’s average. US Futures averaged US$42.91 a barrel, down US$3.15 from October and Brent averaged US$48.25, down US$3.56 on the month. Meanwhile, Asian naphtha market softened amid ample arbitrage flow from the West of Suez to the East. Trading activities in the Asian naphtha market thinned over the month, as most end-users had covered their spot requirements for H2 December. For November, spot naphtha prices were down 1.4%. European naphtha complex also remained long amid lack of demand.

Ethylene prices hit a four-month high in Asian markets on healthy demand and deepsea cargoes not easing supply tightness in November. European spot prices also touched a near-three month high following the outage of Shell Moerdijk steam cracker in the Netherlands. In US, ethylene spot prices slipped on the month on the back of restarts at two Texas plants with ChevronPhillips and Huntsman resuming production. Prices were up 12% in SE Asia, while European spot rose 16.5% on the month. US spot prices edged down 0.8%. Paraxylene prices in Asian markets fell amid heavy selling interest and weakness in upstream isomer-mixed xylene markets. Asian marker, the CFR China was down 1.7% from last month. In US, paraxylene spot tracked Asian movement while lack of liquidity muted spot movement. European paraxylene declined as markets moved sideways, down 3.5% while US spot was assessed down 0.6% from previous month.

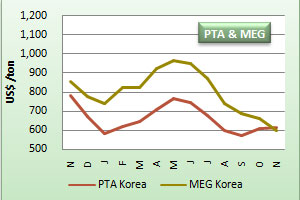

Asian MEG prices declined 9.5% in November on negative outlook and surplus stock, triggering short-selling. In Europe, MEG prices spiked on supply concerns as Shell Chemical declared a force majeure on ethylene cracker in Moerdijk. In US, MEG spot was stable while supply remained limited. European spot was up 15.8% from October while US spot was at US cents 32.50 per pound FOB USG. Purified terephthalic acid prices edged up in Asian markets on end-user and producer buying interest. End-users were reportedly actively buying US$-denominated spot cargoes from both producers and traders amid more competitive offers heard for early December loading. Prices inched up 0.7% from October while European price rolled over. Polyester chip markets were ranged bound and trading in semi dull chip market was insipid, with values stable. CDP chip markets were also stable overall amid lustreless trading. Offers for semi dull chips slipped 1.8% and super bright chip was down 1% from October.

Polyester filament yarn markets in China witnessed sidelined stance in November to prevail with offers for some specs lowered and discount available on firm deals. In India, POY market was weak, seeing limited uptick and most buyers adopted a wait-and-watch stance. In Pakistan, offers for some specs of DTYs were down, with sellers providing smaller discounts. In China, POY 75/72 prices rolled over while Indian POY 130/34 prices were down US cents 2 a kg. In Pakistan, 300/96 DTY prices were down US cent 1 on the month. Polyester staple fibre prices slipped in November as crude oil markets were sluggish and the entire polyester chain remained gloomy. In India, producers’ price remained unchanged since early September while traders had no intention to build inventories. However, prices edged down due to weak INR. In Pakistan, PSF prices remained weak in the domestic market, in line with a similar drop in the Far East. In China, 1.4D PSF was down US cents 3 from October. In India, 1.2D PSF prices fell US cents 2 from last month. In Pakistan, prices in Karachi lost US cent 1 from previous month.

Spun polyester yarn offers in China were lower in November amid thinner liquidity. In India, spun polyester prices were stable with strong support from stable PSF prices, which have been rolling over since early September. In Pakistan, spun polyester yarn prices have marginally declined on the domestic market in Pakistan, despite anti-dumping duties on Chinese PSF have raised raw material costs. In Qianqing, offer for 32s polyester yarn was down US cent 5 a kg while offers for 32s in Shengze were down US cent 9 a kg. In India, 30 polyester knit yarns were down US cents 2 in Ludhiana market while the same in Pakistan was down US cents 6.

Courtesy: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide