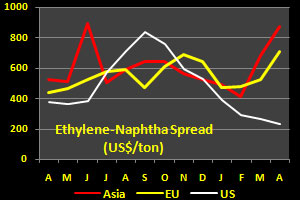

Asia ethylene-naphtha spread jumps back to June Levels, Europe follows

YarnsandFibers News Bureau 2015-05-19 00:00:00 – MumbaiIn April 2015, Asian ethylene-naphtha spread hit a record high amid bullish ethylene markets. The spread jumped US$193 during the month on an average as ethylene prices were under pressure of tight supplies. The CFR Northeast Asia ethylene marker averaged US$1,368-1,370 a ton while the Southeast marker averaged US$1,423-1,425 a ton, both increasing US$214-240 on the month. The spread was over and above the US$269 a ton recorded in March.

Meanwhile, the CFR Japan naphtha prices averaged US$551 a ton, up US$21 from March, thus expanding the spread. Seeing the jump in Asia, European spread also jumped US$182 a ton in April to US$708 a ton. US was slower in April with spread shrinking US$32 a ton to US$236 a ton. Compared to a year ago levels, the spread were up 60-67 per cent in Asia and Europe and down 37 per cent in the US.

Asian ethylene prices started climbing in early February and hitting a six-month high of US$1,429-1,431 a ton CFR NEA in the last week of April, driven by supply tightness emanating from steam cracker turnaround season in the second quarter. In South Korea alone, three steam crackers were out of the eleven scheduled for shutdown in Q2 for annual maintenance. This implies that around 35 per cent of South Korea's total ethylene capacity will be shut. To top it, several other unplanned steam cracker outages are reported in the region.

The bullish run in Asian ethylene market has opened the arbitrage window from the US to Asia and around 30,000 ton of spot ethylene is been fixed for May to July delivery. Another 4,300 ton spot cargo would arrive in Northeast Asia in July from Mexico. Despite many deep-sea cargoes arriving in Asia, ethylene markets still remained strong as spot demand was healthy amid positive margins for styrene monomer production.

Asian ethylene markets are likely to remain firm until the end of June.

Courtesy: Daily Textile Prices Service

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide