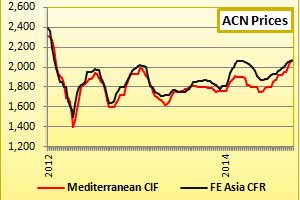

Acrylonitrile prices hit high last seen in April 2012

YarnsandFibers News Bureau 2014-09-01 16:46:00 – MumbaiIn the week ending 29 August, acrylonitrile prices were seen hitting more than two-year high in Asian and European markets amid continued tightening of regional and global supply. Prices have been on the rise for the last 16 weeks on active demand in a short supplied market.

In Europe, tight supply pushed prices up to a high last seen in April 2012. In US, acrylonitrile domestic prices rose to a nearly four-month high due to higher feedstock chemical-grade propylene contract prices for August. However, trading atmosphere was lukewarm in China and producers mostly pegged offers firm, but downstream buying was insipid, leading to thin liquidity.

Asian acrylonitrile marker, the Far East Asia CFR was in the range of US$2,074-2,076 a ton, rising US$15 on the week. Offers for spot cargoes in China were heard at US$2,020-2,050 a ton. European acrylonitrile spot prices were assessed at US$2,058-2,062 a ton CIF Mediterranean. The same in US rose to a high of US cents 100 per pound delivered.

Feedstock, propylene prices declined in Asian markets due to weak buying sentiment and easing support from upstream energy complex. Meanwhile, September US contract price was nominated up for chemical-grade and polymer-grade propylene, following planned production outages. European September contract price was fully settled down from August, but spot was dearer on the week. Asian propylene markers CFR Far East Asia was assessed at US$1,374-1,376 a ton while FOB Korea marker was at US$1,324-1,326 a ton. In Europe, chemical-grade propylene prices were at Euro992-996 a ton FD NWE and Euro962-966 a ton CIF NWE. US spot chemical-grade propylene inched up to US cents 67.25-67.75 per pound delivered.

The firmness in acrylonitrile is likely to soften soon as demand has started to dissipate slightly while feedstock prices consolidating at low levels. The only support to acrylonitrile producers is the normal inventory level as their run rates dropped a bit. Downstream ABS market corrected downward, as traders took a cautious stance due to inactive buying in recent weeks. Acrylamide producers were running at reduced rates thus demand remained weak, leading to thin liquidity. Run rate of acrylic staple fibre makers also dropped to close to 80 per cent recently. Overall, it is anticipated that acrylonitrile price will continue to remain ranged bound for weeks to come.

COURTESY: YnFx Weekly PriceWatch Report and Daily Textile Prices Service

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide