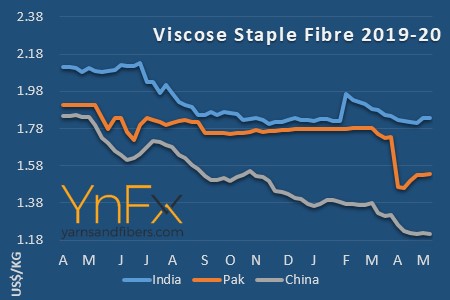

Viscose pricing upward momentum decelerates entering off-season

YarnsandFibers News Bureau 2015-07-29 10:28:07 –VSF markets remained northbound in the week ended 24 July, but the upward momentum somewhat decelerated given the recovery in production and hard to push cost pass-on to downstream buyers. In China, producers raised offers for medium-end and high-end goods while transactions followed up gradually. In China, offers for medium-end VSF were raised US cents 5 a kg from previous week high-end VSF was dearer by US cents 6 a kg. Downstream spun yarn markets were range bound weakly given the distinctive off-season atmosphere and mills cautiously purchasing VSF at high price levels. Prices in India and Pakistan generally rolled over.

Meanwhile, VFY prices rolled over for the first-class, second-class, and third-class VFY 120D in China. Transactions were fair, with some producers reporting increased offtake. Prices in India also rolled over on cost support while export demand was losing strength due to competitive offers from China. Less than 1 million kg of VFYs were exported in June to 25 countries from India valued at US$4.1 million. Japan continued as the major importer of Indian VFY, followed by Germany and Turkey during June.

Viscose raw material, dissolving pulp markets changed little as offers for soft wood pulp were stable at US$880 a ton, and suppliers tended to raise their offers further, as they had met their targets of the month. Offers for hardwood pulp were at US$840-860 a ton, with trades heard at US$840-850 a ton. Some mainstream suppliers tended to issue fresh offers by US$20 a ton in coming weeks.

Courtesy: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide