Viscose markets facing strong downward pressure as supply expands

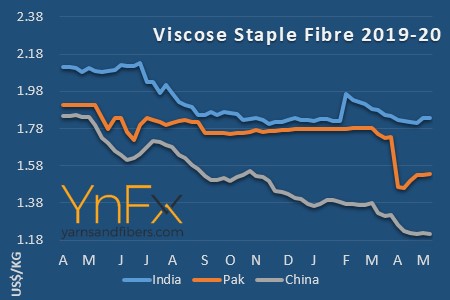

YarnsandFibers News Bureau 2015-05-25 11:43:08 –Asian viscose fibre markets witnessed strong downward pressure from both expanding supplies and season lull in downstream textile industry. Thus prices softened partially. In China, bearish stance prevailed in VSF market, given the restarts of Xinjiang Shunquan’s and Aoyang’s units, as well as the upcoming startup of Yibin Grace’s new unit. Downstream yarn makers bought with caution, either digesting their stocks or sourcing low-priced goods. Prices were down in China while they rolled over in India and Pakistan.

In India, producers’ prices were stable at US$2.22-2.33 a kg after they were hiked in the first week of May. In Pakistan, 1.5D VSF prices rolled over at US$2.06 a kg, after the previous week’s hike. In China, offers for medium-end VSF were down US cents 5-6 a kg while high-end VSF goods were down US cents 4 a kg on the week.

Viscose filament yarn prices were hiked in China as supplies fell with a plant idling and inventory with producers down amid favorable demand in both domestic and export markets. With raw material costs unchanged to softening in the meantime, filament producers enjoyed good margins. Prices rolled over in India. In China, 120D dull VFY offers were hiked US cents 5 from last week. In India, 120D bright VFY was pegged at US$5.96-5.99 a kg, unchanged from last week.

Upstream, dissolving pulp markets saw weaker trading atmosphere and no fresh offers or deals were heard for softwood pulp. Discussions for hardwood pulp also softened, impacted by the downstream VSF market movements. Softwood pulp was transacted at US$840 a ton while discussions for hardwood pulp also softened, although producers held to their offers at US$815-820 a ton.

Courtesy: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide