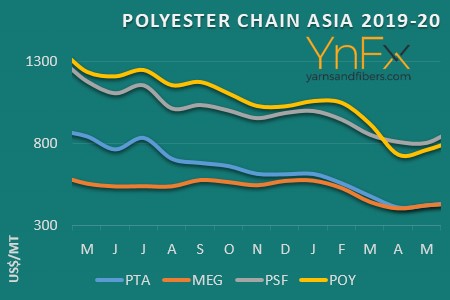

Polyester intermediates (PTA, MEG, PET) prices weaken on low buying

YarnsandFibers News Bureau 2019-11-12 07:59:18 –In the first week of November, polyester chip (PET) prices in Asia were steady-to-soft amid a decline in the raw material PTA and MEG markets in the week. In China, semi-dull prices were lowered while that of super-bright chip were stable-to-soft during the week. Market sentiment was insipid as downstream buyers were digesting their previously bought stocks. And as a result, trading activity was lackluster during the week. Meanwhile, supply is likely to pile up in the near-term. Overall, PET chip offers will remain stable-to-lower in the coming weeks as demand-supply dynamics might change.

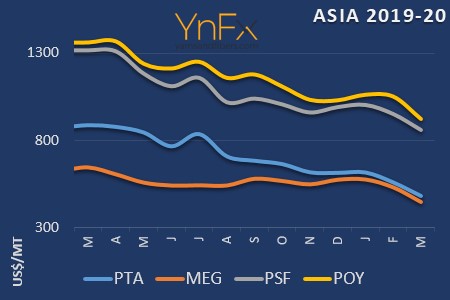

Purified terephthalic acid (PTA) prices in Asia receded during the week amid lower feedstock costs and expectations of expanding supply in the near term. Demand in the PTA markets was soft which lead to lower overall trading volume during the week. Margins were also low in the week.

South Korea's Hanwha General Chemical will resume operations at its Daesan PTA at the end of November. It has around 700,000 tons per year of PTA capacity. China's Hanbang Petrochemical resumed operations at its No 2 PTA plant which has 2.2 million tons per year of production capacity.

Mono ethylene glycol (MEG) prices in Asian markets fell to a two-month low level amid the upcoming new supply in the market during the week. Prices declined despite higher ethylene cost in the week. In the US, mono ethylene glycol markets were flat amid seasonally low buying in the last month. Meanwhile, the third quarter MEG production in the US fell due to weak downstream demand. In Europe, the mono ethylene glycol market witnessed soft demand during the week.

South Korea's Lotte resumed operations its Daesan MEG units of 650,000 tons per year of combined production capacity. China’s CSPC also resumed operations at its 400,000 tons per year MEG plant in the week.

Courtesy: YnFx Weekly Textile PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide