Polyester fiber, yarn prices firmer amid a rebound in PTA and MEG markets

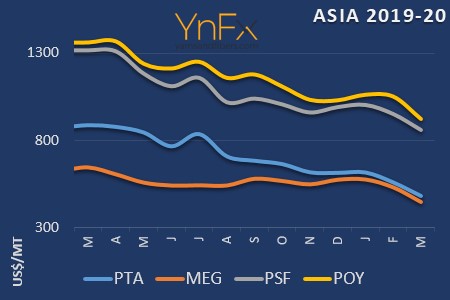

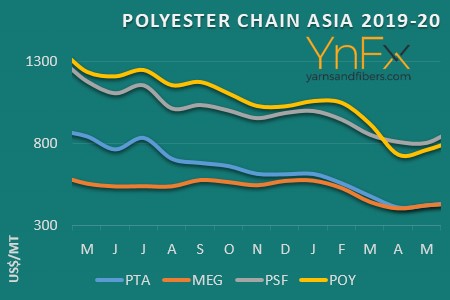

YarnsandFibers News Bureau 2020-07-07 15:54:55 –In May 2020, polyester filament yarn prices recovered in China supported by higher prices in the polyester staple fiber markets. Market transactions improved in the first half of May due to massive procurement by the downstream units but buying sentiment softened later. In China, POY 75/72 prices were up US cents 4 a kg in Shengze while Indian POY 130/34 prices were down US cents 2 a kg.

Polyester spun yarn prices in May were firm in China underpinned by recovering polyester feedstock markets. In India, spun polyester yarn prices were steady amid quiet market sentiment while lock-down eased in some parts of the nation. In Pakistan, polyester yarn prices were flat amid muted buying interest during the month. In Shengze, offers for 32s polyester yarn were up US cents 1 a kg. In India, 30 polyester knit yarns were stable in the Ludhiana market. In Pakistan, the 30s spun polyester was down US cents 2 a kg as compared to last month.

Polyester staple fiber (PSF) prices were range-bound in China on decent buying sentiment and higher costs in the upstream polyester markets in May 2020. However, the buyers were cautious after the price hikes in the H1 of May. The trading activity cooled down in H2 comparatively. Prices in India and Pakistan were flat amid movement restrictions in the countries. In China, 1.4D PSF offers in May were stable as compared to April. In India, 1.2D PSF prices fell US cents 2 a kg from the previous month. In Pakistan, prices in Karachi were down US cents 2 a kg on the month.

Polyester intermediate markets

Polyester chip (PET) prices in Asia moved up amid rising prices in the polyester markets in May. Offers for semi dull chips moved up by 3.4% and super bright chip rose 4.2% in May.

Mono ethylene glycol (MEG) prices in the Asian markets climbed in May on improved demand and expectations of supply crunch in June. In the US, spot mono ethylene glycol (MEG) prices were soft amid firmer demand and increased supply. In Europe, mono ethylene glycol (MEG) producers saw declining margins as compared to last month on the back of stronger ethylene costs. Asian MEG prices rose 4.9% in May while European spot was down 13%. US spot declined by 13.2% for the month.

Purified terephthalic acid (PTA) markets in Asia gained in May due to higher paraxylene and crude oil costs. However, the buying sentiment was soft and supply was relatively high in the market. In Europe, May PTA contracts largely rolled over as compared to the previous month. CFR China average prices rose 5.2% from April while European price was up 1.1% in May.

Upstream polyester markets

Ethylene prices in the Asian markets surged in May amid expectations of tighter market in June and stronger buying sentiment due to restocking activity. In the US, spot ethylene prices moved up after ethane prices increased higher and amid cracker issues that resulted in limited production during the month. In Europe, ethylene markets softened despite recovering upstream markets, amid weak demand. Asian average prices rose 51.73% from April while European spot was down 1.5%. US spot prices jumped by 34.1% on the month.

Paraxylene (PX) prices in Asia rebounded in May on bullish upstream costs while supply was ample and market fundamentals did not improve significantly. In the US, paraxylene prices climbed on scarce availability due to planned maintenances and firmer demand. In Europe, paraxylene prices rose due to higher costs, however, the demand was still weak. Asian marker, the CFR China prices rose 3.9% from the previous month while European paraxylene was up 4.4%. In the US, spot paraxylene was climbed 7.7% in May.

Courtesy: YnFx Monthly Textile PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide