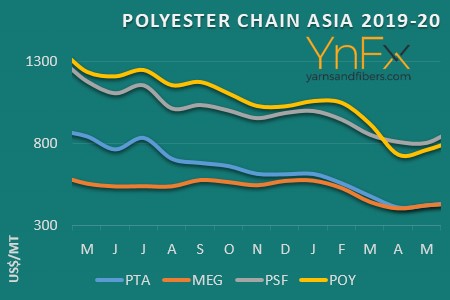

Polyester chip prices rise in China

YarnsandFibers News Bureau 2017-01-04 07:25:48 –In China, semi dull chip offers were up US$80 a ton in the second week of December while super bright chip offers jumped US$70-85 a ton on the week. Offers for CDP chip surged US$85-120 a ton during the week.

Asian marker for semi-dull continuous spinning fibre grade chip rose US$50 a ton FOB Taiwan/Korea on the week.

Polyester chip prices rose before holding stable that week. Bolstered by crude oil market that went strong on output cut agreement, offers for SD chips hiked and some producers even withdrew offers. Early that week, given low inventory of PET chips, strong feedstock market caused PET chip producers to revise offers up.

During the second half of the week, as US FED lifted interest rates, drove players in polyester market to the sidelines. Super bright chip market mirrored the trend in SD chip market.

Mid?week, despite weakening feedstock market, SB chip offers were firm given tight availability. CDP chip prices were hiked that week as mainstream offers rose and firm deal followed up amid producers reporting low inventory.

Courtesy: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide