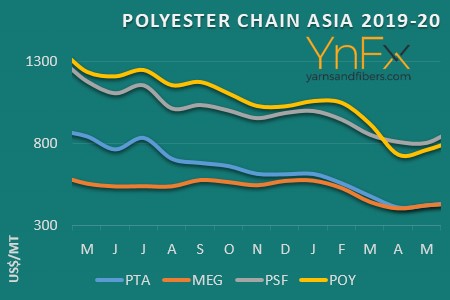

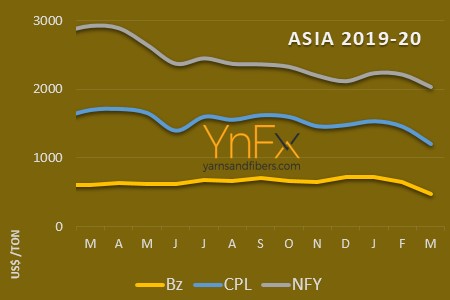

Polyester chain pricing correction continues reflecting oil deflation

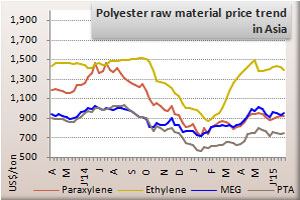

YarnsandFibers News Bureau 2015-07-09 10:11:44 –Polyester chain prices have started reflecting the deflating oil prices. Beginning at the upstream ethylene prices fell in Asia but gained in US on supply imbalance. Similarly, paraxylene markets moved either sides across markets. In contrast, downstream PTA and MEG markets edged up seeing demand revival for both and recovering past week’s fall. Filament yarn and polyester were in tandem with raw material pricing in the week ended 26 June 2015.

During the week, ethylene markets fell US$10-30 a ton CFR NEA and CFR SEA amid sluggish traded as supplies were expected to rise while bid/offer gap remained wide. In Europe, supplies from the Middle East improved and were expected to relieve pressure on European buyers. Meanwhile US ethylene spot lost US cent 0.75 per pound FD USG as supply improved and prices were at their two-month low.

Paraxylene prices fell US$3.50 on the week in Asian markets as downstream PTA futures dipped in China and ahead of discussion for July Asian contract price nomination. However, the markets were very likely to remain firm on cost support. In Europe, the spread between mixed xylenes and paraxylene narrow to below production costs. Spot price were also down US$3 on the week In US, spot paraxylene assessments rose US$35 a ton FOB USG on the week amid tight supply and poor economics.

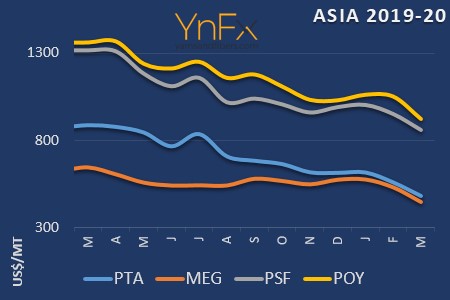

MEG prices edged up US$18 a ton CFR SEA and US$3 a ton CFR China but were capped by weaker futures and piling inventory at producers. Spot prices had mostly recovered last week's drop. US spot MEG price was unchanged at US cents 41 per pound FOB USG with expectations for the market to remain mostly stable. European MEG spot prices fell Euro10 on the week a ton NWE FCA on the prospect of bearish supply.

PTA prices edged up in Asian markets but were capped by weak PTA futures which sank on Zhengzhou exchange. In European PTA were static for the fifth consecutive week despite June paraxylene contract price was fully settled. In US, PTA June price could be higher since spot paraxylene had risen from the May price. Polyester chip markets were mainly range bound as trading was insipid during the Dragon Boat Festival. Asian PTA markers gained US$3 a ton CFR China while European PTA price rolled over at Euro763 a ton FD NWE.

Offers for semi dull chip dropped US$10 a ton from last week post Dragon Day holiday and negotiating prices fell sporadically. Super bright chip markets took on a similar stance of SD chip market. CDP chip markets were range bound and trades were thin with fluctuating prices. Downstream PFY markets remained bearish given the weak cost and limited buying interest.

In China, PFY producers pegged offers largely stable as activity was quiet in Jiangsu. Indian POY market was stable amid bearish sentiment and producers lowered offers for some specs. In Pakistan, DTY prices saw notable decline although producers pegged offers stable to promote sales. DTY 300/96 was down PakRs2 to PakRs73-81 per pound or US$0.72-0.80 a pound, down US cents 2.

PSF markets were on a decline and were marginally supported by feedstock markets. In China, after a brief fall on early in the week, the markets were rather stable though activities thinned. Offers for 1.4D direct-melt-spun were down US cents 1-2 from last week. They started softening again weekend after the feedstock settlements were announced. Prices in India and Pakistan were stable.

Courtesy: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide