Caprolactum price remains stable amid snug supply

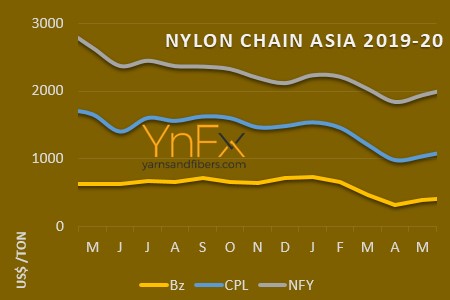

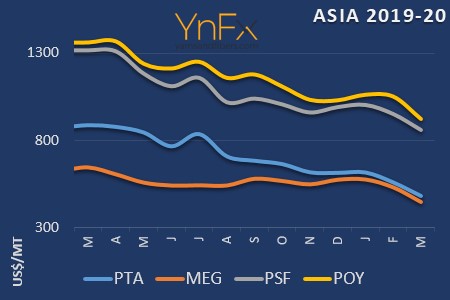

YarnsandFibers News Bureau 2015-12-22 09:28:38 –In the second week of December, the SE and FE Asian markers rolled over at US$1,250-1,270 a ton while December contract price for high-end goods was offered at US$1,370-1,430 a ton CFR.

In China, liquid good offers in spot market were at US$1,630 a ton while solid goods were at US$1,680-1,695 a ton.

Sinopec retained December contract nomination at US$1,650 a ton while DSM Nanjing raised its nomination to US$1,695 a ton, up US$5 from last week for solid goods.

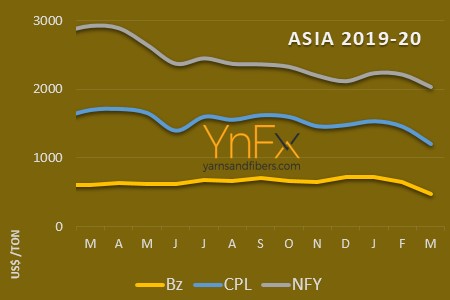

Caprolactum prices were stable that week, taking strength from snug supply and ignoring the drop in benzene prices.

Liquid good offers were rolled over while mainstream offers for solid goods remained unchanged.

Demand was modest as run rates of polymerization units increased while inventory level was at 7 days’ worth. Run rates at yarn makers slipped with inventory higher at 29 days’ worth.

With benzene values drifting, market prices approached on an increasingly bearish note amid snug supply, markets will pay attention to the dynamics in crude oil and benzene markets in coming weeks.

Courtesy: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide