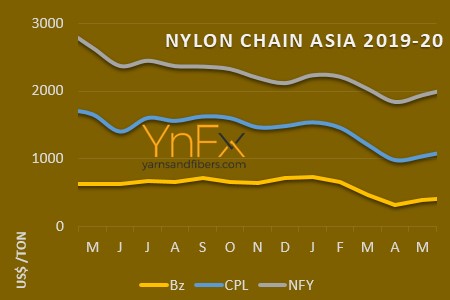

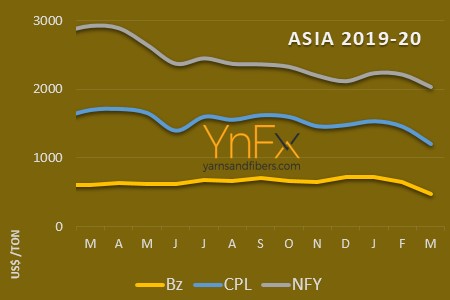

Caprolactum price continue to decline in Asia

YarnsandFibers News Bureau 2017-09-05 07:37:09 –In China, spot liquid good offers fell US$129 a ton in the fourth week of August while solid goods were similarly down US$144 a ton on the week.

Sinopec settled August contract at a decrease of US$120 a ton from nomination. European goods were stable at US$1,700?1,720 a ton.

Caprolactum prices were again adjusted down in Asian markets amid cautious buying interest and long supplies. CPL market weakened as trading was also insipid.

Yangquan Coal Industry delayed the startup of two CPL lines to end August, due to shutdown of one on environmental regulation. Combined capacity of CPL lines amount to 200,000 tons per year.

Domestic run rate went down to 84% that week. It is expected that supply will be longer next week. Run rates of polymerization units were up to 73% and inventory level was at 5 days’ worth. Run rates at downstream yarn makers were down with inventory at 20-25 days’ worth.

Overall, given slightly higher benzene against increasing CPL inventory, CPL market will drop somewhat.

Courtesy: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide