Next-gen materials to see continuous growth, report finds

YarnsandFibers News Bureau 2022-04-05 01:59:33 – NetherlandsIn the fashion business, next-generation materials are quickly gaining traction, with a new analysis estimating that the worldwide wholesale market would be worth US$2.2 billion by 2026.

Industrial animal farming for goods such as leather, fur, silk, wool, down, and exotic skins, according to the Materials Innovation Institute (MII), is a leading cause of many of the pressing problems of our time, including climate change, environmental degradation, public health risks, and animal cruelty.

According to a new MII research, 55 of the 95 companies working on next-generation materials have been created since 2014. The majority of these 55 new businesses (41 of them) are focused on leather biomimicry. Five enterprises focused on silk biomimicry, five on wool, four on fur, three on down, and one on both leather and exotic skins were founded within the same time period.

MII said that the amount invested in next-generation materials in 2021 is more than double what it was in 2020. Furthermore, despite the Covid-19 pandemic, monies invested in 2021 were roughly equal to the previous four years combined.

While the number of deals hasn't increased significantly from 2020 to 2021, MII claims that the amount of money invested has more than doubled, indicating that larger deals are to be expected as firms mature, provide proof of concept, and scale.

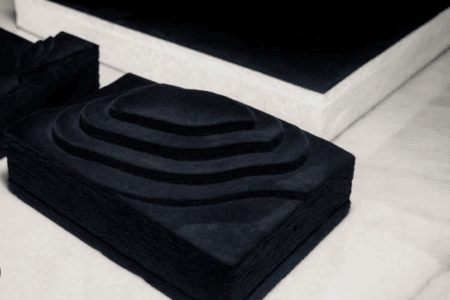

Allbirds, a sustainable footwear and apparel firm, spent $2 million in Natural Fiber Welding (NFW) and its Mirum technology in February as part of its effort to introduce a sustainable leather alternative to the fashion industry.

The number of fashion brands looking to embrace next-generation materials is also increasing, according to MII.

Nicole Rawling, CEO of MII, said in the report that MII has visited 40 of the world's most well-known fashion labels, and all but two are actively looking for next-generation materials to include in their supply chains. With so many new next-generation material options on the horizon, companies and consumers will soon have more options than animal-based leather, wool, silk, down, fur, and exotic skins.

Elaine Siu, chief innovation officer, adds that many sector companies have clear, publicly publicized targets and pledges to achieve demonstrable gains in sustainability. Given the enormous influence, raw materials have on a brand's environmental footprint, it's likely that these goals will be mostly met by switching from incumbent (and current-gen) materials to next-gen alternatives. These sustainability pledges, both in terms of volume and timescale, provide a useful benchmark for material inventors and investors when estimating the potential market size and growth rate of the next-generation materials business.

However, as Jacqueline Kravette, a board member of the MII, points out, one of the challenges to the adoption of next-gen materials is their availability at scale.

Kravette said that at this time, the present materials sector is unable to provide sustainable choices at a scale that fulfill the performance, aesthetics, and cost criteria of brands. They find that there are relatively few existing solutions that suit a brand's standards and meet their environmental goals when they help them source these next-gen materials. They've said it before and they'll say it again: perfection cannot be the enemy of good. To put it another way, while they aren't yet at 100% cradle-to-cradle sustainability, switching to next-generation raw materials will have considerable environmental benefits.

According to the research, advances in science and technology, customer tastes, and regulatory developments are all driving the next-generation materials business forward.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide