India to benefit from the imposition of US duties on Chinese imports

YarnsandFibers News Bureau 2019-09-16 00:00:00 –The trade conflict between the US and China may be unsettling global trade. But home-textile exporters from India see a silver lining, though benefits could be insignificant if US demand remains subdued.

Indian companies expect to benefit from the imposition of US duties on imports from China. Beginning September, import duties will kick in on home textiles, including towels and sheets.

India is a large producer and exporter of such products. As US buyers diversify their purchases, local companies can expect to benefit. “Indian home textile exporters stand to benefit in volumes/market share if the duty persists," analysts at JM Financial Institutional Securities Ltd said in a note.

Domestic home-textile producers echoed the view. In an interaction with analysts, managements of Welspun India Ltd, Indo Count Industries Ltd and Himatsingka Seide Ltd alluded to the advantageous context the tariffs create for Indian companies in the US market.

But, as Shrikant Himatsingka, managing director and chief executive officer of Himatsingka Seide, pointed out, most companies are still in a wait-and-watch mode and they are yet to see a spurt in orders.

“In pure theory, I should say the probabilities favour India in terms of being a preferred source. So, we all remain on observation mode in terms of what really transpires when these tariffs take effect. But we are not seeing any spike in demand at least as far as Himatsingka is concerned. It definitely raises interest, but transmission at this point is muted," he told analysts last month.

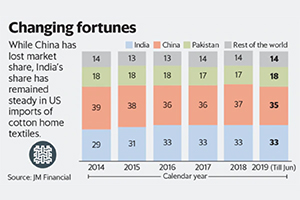

Still, optimism is palpable. Indo Count’s management highlighted the decreasing share of China in cotton-fashioned imports to the US. Separately, data compiled by JM Financial showed a notable year-on-year expansion in India’s share in June, as China lost market share. For the year to June, India’s share has largely been steady.

A significant portion of China’s share is being captured by other emerging countries such as Vietnam and Bangladesh, said an analyst, who declined to be named. Compared to India, these countries have better trade pacts with the US and offer superior incentives to their domestic producers, sharpening their competitive edge, added the analyst.

Even then, for Indian home-textile companies to see any noticeable benefit, demand should also shape up. Purchases by US retailers have been tempered by slowdown fears, warned Welspun India. A deceleration in demand would cut into market share benefits.

“In anticipation of a slowdown, retailers are probably looking at re-calibrating their offtake so that nobody wants to sit on a large pipeline. That is the impact which we will see. As we head toward the holiday season, we might see that this situation could be recalibrated," Welspun India told analysts.

Courtesy: Live Mint

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide