Cotton Futures record sharpest weekly decline in 6 months

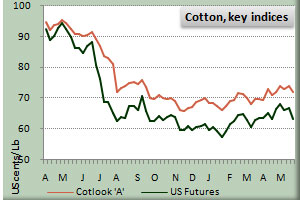

YarnsandFibers News Bureau 2015-05-26 12:17:13 –Cotton futures on the ICE fell for the fifth straight session in the week of 22 May, ending their worst week in more than six months as stronger US$ continued to prompt speculator liquidation, though traders noted prices remained locked in a tight trading range. July contract settled down US cents 3.54 or 5.3 per cent n the week to US cents 63.30 per pound.

July cotton's discount to December cotton rose to US cents 1.08 from US cent 0.02 last week. The Cotlook A index also fell US cents 2.15, closing the week at US cents 71.85 per pound. The China Cotton Index was up 9 Yuan to 13,365 Yuan a ton. The rise followed the forecast that cotton sowings will drop to their lowest in 56 years.

In Pakistan, cotton prices moved higher on persistent demand mills and spinners. The official spot rate was hiked PakRs50 to PakRs5,650 per maund ex-Karachi. According to reports, mills were active to cover the forward deals, so that they would be able to meet urgent requirements. Rates firmed up due to tight supply position while experts opined that prices may ease slightly if arrivals of new crop begin earlier.

In India, cotton price traded lower on limited buying by domestic mills. Traders said that demand was there but as prices fell mills started buying. Prices were down INR500-1,000 per candy on the week.

Courtesy: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide