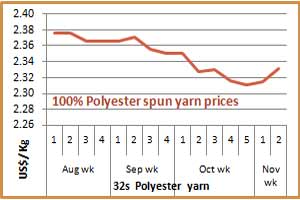

Polyester spun yarn prices stable as markets roll over

YarnsandFibers News Bureau 2013-11-22 14:24:57 – MumbaiLast week, the polyester spun yarn markets remained tepid with limited new orders as buyers awaited for signal from the upstream fibre markets. In China, offers changed marginally, but transaction weakened. PSF prices briefly rolled over, with the central level

at US$1.60 a kg. PSF makers feared that any attempt to raise price offers would be strongly opposed and may result in reduction in operating rates. Margins have been falling in recent weeks. In India, PSF prices kept softening, last week by Re1 or US cents 2 a kg and spun yarn markets remained extremely weak, with rising inventory. Indian 100% polyester spun yarn 30/1s was pegged at US$2.00 a kg, rolling over week on week while 100% mélange 30/1 black was at US$2.45 a kg. In Pakistan, 30/1 was at US$2.77 a kg, unchanged same as in the previous week. PFY markets held stable and offers were largely maintained by producers, with POY and FDY on a weak note. With inventory mounting discounts were offered in firm deals as market sentiment was insipid and players carried a cautious attitude and moved onto sidelines. In Pakistan, PFY market sentiment was placid, and offers were maintained at producers, with trading volume on the decline. Indian PFY market was bearish and offers were maintained but trading sentiment was stable. What stabilized polyester? Upstream ethylene prices continued to decline for the 12 consecutive weeks in Asia, due to weak buying interest. Also the movement between North and South Asia were diverse, depending on supply and market fundamentals. European ethylene spot prices were down as incremental demand remained hesitant while US spot jumped pushed to a 12-week high. Paraxylene markets in Asia weakened on bearish mixed xylene markets and low interest for November/December cargoes. The US November contract price for paraxylene was settled lower than October in line with the expectations given lower spot pricing and also at its lowest since August 2012. Meanwhile European spot tracked further decline in Asian prices and were down over the week. An initial contract price for November was settled down from October numbers. With feedstock resisting the rise, MEG prices slipped in thinly traded Asian markets as periodic buying ended after two weeks of rallying liquidity. US MEG was assessed lower, but remained too high for export. An initial European MEG contract price was settled down on October. Meanwhile, PTA prices declined in Asian markets dragged down by the China market's bearish sentiment and surplus supply. US November PTA price was not settled as the market awaited settlement of paraxylene contract. European demand for PTA faced further hits as maintenance turnarounds and rate cuts in PET market kept demand weak and plunging prices.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide