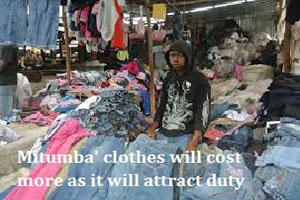

Mitumba' clothes will cost more as it will attract duty

YarnsandFibers News Bureau 2016-07-13 16:00:00 – AfricaSecond-hand clothes, popularly known as mitumba, are mostly imported from North America and Europe into Kenya. Most of these second-hand clothes are sold in Gikomba Market, Nairobi. It is estimated to hold close to 65,000 traders. According to the Finance Bill 2016, all imported clothes will attract a duty of $0.4 (Sh40.8) per kilogramme of clothes up from $0.2 (Sh20.4) per kilogramme, the Government believes is as a win-win solution to the mitumba trade that has crippled the country’s textile industry.

Job Kabochi, a tax partner at audit firm PricewaterhouseCoopers (PWC), said that the Government has done this to encourage the struggling textile industry and encourage local manufacturers. The Government has also curtailed the importation of garments into the country.

He added that there is a specific provision in the legislation which actually allows any garments which are manufactured by the country’s export processing zones (EPZs) and then sold locally in the local market to enjoy VAT exemption as well as duty remission.

Treasury Cabinet Secretary Henry Rotich in his Budget speech proposed to exempt from value-added tax (VAT) garments and leather footwear procured from EPZ.

Rotich said that the application of import duty and propose to exempt from VAT made up garments and leather footwear procured from the EPZ to enable Kenyans to acquire new clothes and shoes at affordable prices.

It is not the first time the Government has proposed to stop the entry of mitumba into the country. Within the East African Community, there have been plans to ban mitumba.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide